Table of Content

Eligible customers may now access our Sustainable Home Discount Offer, opens in a new window. If your customer requires LMI as part of a new home loan, you can offer them a 5% discount on the LMI premium payable if they meet the eligibility criteria. The LMI discount is offered by QBE Insurance who is NAB’s LMI insurer. Having the opportunity to offer your customers a $2,000 cash bonus when they refinance their home loan to NAB could make that move a little easier.

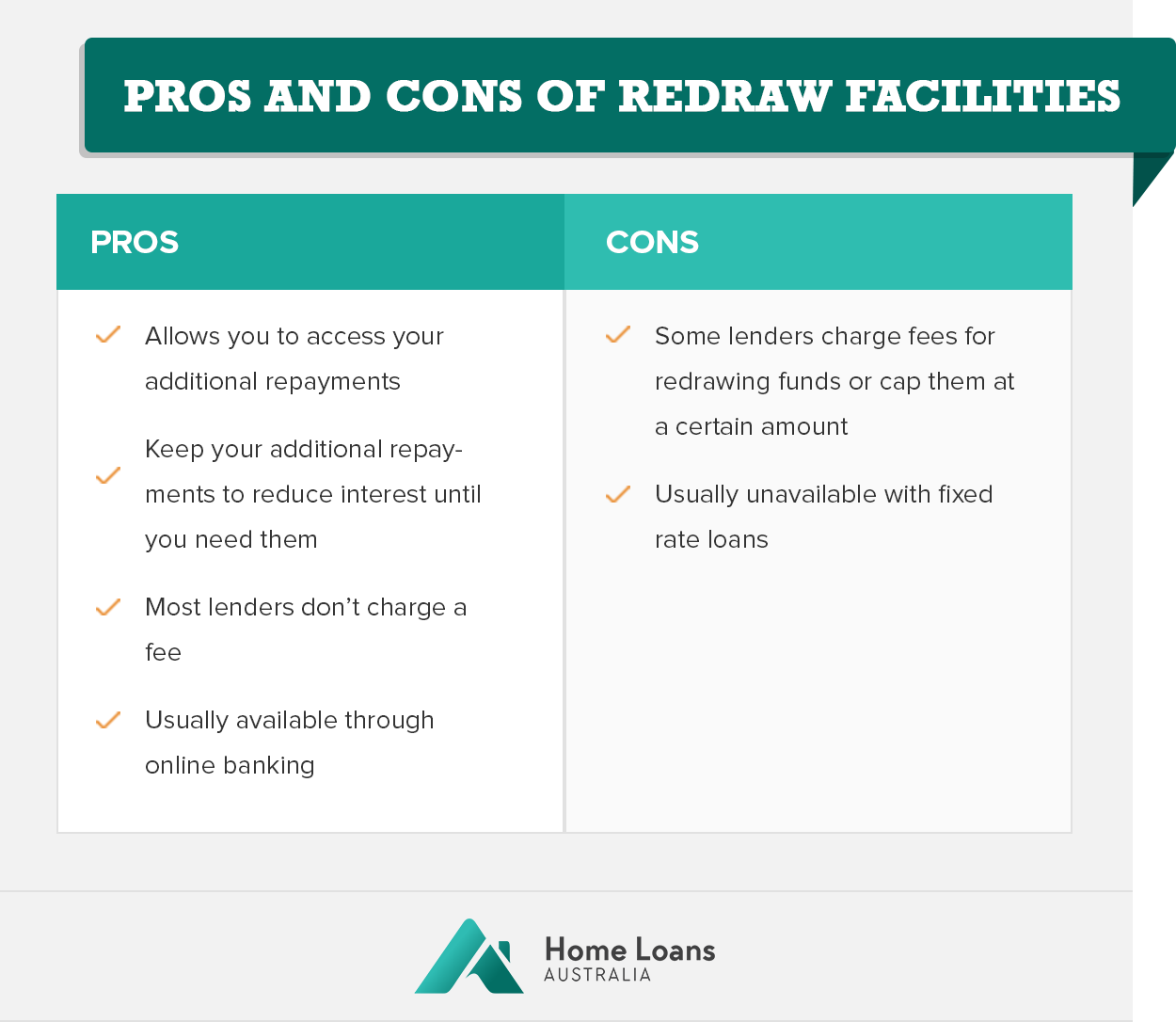

Remember, if you choose to withdraw money from your available redraw, your home loan balance, repayments and the time it takes to pay off your loan will increase. The available redraw is now calculated as the difference between your current mortgage balance and the mortgage balance if you had not made any additional repayments. However, some home loans have a set maximum amount you can redraw irrespective of the additional repayments you’ve made. When damage occurs to a home, homeowners submit their claim to their homeowner's insurance company.

Property Insurance

When they submit your refinance application to the bank, they know how to negotiate the best deals and strengthen your application. The $2,000 NAB home loan refinance cashback offer is available on all of its home loan products. Additional flexibility, features and discounts come when a variable rate loan is bundled with a NAB Choice Package. Any other product offers from NAB are independent from this NAB Home Loan Refinance Cash Bonus offer and customers can benefit from multiple NAB offers . The offer is only available on refinances from another financial institution and is not available for refinances into UBank, Medfin or Advantedge home loans. The offer is available on all NAB Home Loan products excluding lines of credit, the NAB Portfolio Facility, the NAB Private Portfolio Facility and loans for building and construction purposes.

Generally, this is the best choice for larger loan sizes as borrowers must either hold or be approved for a Westpac Choice transaction account linked to their home loan. The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs.

How to register for Redraw

This offer is available to individual applicants who are owner-occupiers or residential investors. Refinancing of First Home Loan Deposit Scheme loans and loans to businesses, non-residents, trusts, and other non-natural people are not included. You must also hold an NAB transaction account at the time of drawdown. At Finty we want to help you make informed financial decisions.

This change caught many customers off guard since many people use their redraw funds as a rainy day fund or emergency savings. A recast is when you apply an additional sum of money to substantially reduce the unpaid principal balance of your loan, and as a result can lower your monthly payment. If your loan is more than 30 days past due, you will be required to pay the Total Amount Due that is shown on your monthly mortgage statement. However, if your loan is not past due, you can elect to have your payment applied to principal or escrow instead of applying it to your monthly payment.

Refinance Home Loan Process: A Step By Step Guide

This means you’ll have money available to take back out – if you want to. One of the benefits of making extra repayments on your home loan is being able to redraw some of those funds. So you can make the most of this feature, we explain how it works and how it can help you achieve small or large goals. The offerings are subject to errors, omissions, changes, including price, or withdrawal without notice. Loans are a big expense for most people and it can be costly to switch lenders.

Any money available in your redraw – whether its $10 or $10,000 – reduces the balance owing on your home loan. At the end of your loan term, both your available redraw and the home loan balance will reduce to zero. First, you’ll have to activate your redraw facility, to do that, you’ll need to fill in and submit your lender’s ‘Redraw Authority Form’.

Rates and information current as at 16 December 2022 and are subject to change at any time. NAB Tailored Home Loan fees, charges, terms and conditions are available on request.NAB Choice Package fees, charges, terms and conditions, opens in a new window. Choice Package discounts and benefits only apply whilst your loan is part of a NAB Choice Package. The available redraw balance will not include repayments made towards your next monthly minimum repayment or uncleared cheques, and may have been adjusted on your monthly repayment date. Redraw is available on mostCommBank variable rate home loans, and there are no fees to redraw. For whatever reasons, lenders may decide not to allow you to redraw any repayments you’ve made.

Assets like shares and vehicles, liabilities such as credit card limits and living expenses. NAB has tried to serve the expat community with lower interest rates. Bank account linked to your home loan that can help to lower the loan interest.

We do this by providing a free comparison service as well as product reviews from our editorial staff. Here are the key features of current NAB owner-occupier home loans and investment property loans. Your customer’s purchased property must be an acceptable property type and within the property price threshold for the suburb and postcode.

Generally, PMI will be automatically terminated when your loan is scheduled to be repaid down to a certain percentage of the original value of the home. For more information, please download the Guide to Conventional Private Mortgage Insurance below. On fixed-rate home loans, 1-year fixed will have an interest rate of 2.59% and 5-year fixed will have an interest rate of 3.00%.

If your payment is due on the first of the month and we receive your payment before the end of the month, then it will not be reported as 30 days late. However, if your payment is due on the first of the month and we don't receive it until the following month, it may be reported as a 30-day late payment. We report your payment to the credit bureaus after the end of each month.

No comments:

Post a Comment